Trade Signals Frequently Asked Questions

Trade signals timing?

Be careful with trade signals generated near/ at begining of Frankfurt/ New York session. Most of bulltrap happen at that time. Market tends to be very volatile when trading begins. Actually even market makers are clueless about whether market will go south or go north. They will do series of AB testing to measure buying and selling forces. DataFeed signals will be more accurate in lower volatility market condition. Very often buy signal is followed by weak-hands washout before uptrend begins.

DataFeed signals work best after significant downtrend. Be careful when market is in overbought condition.

How DataFeed generates trade signals?

DataFeed AI server analyses market data in real-time using artificial intelligence and patiently waiting for perfect market setup. When AI server decides that market gained enough momentum for next bull market leg, AI server sends buy signal for corresponding time frame (m15, m30 and D1 for now).

I don't see sell/ stop signal, only buy signal

Currently our AI server is not smart enough (yet) to figure out optimal trade exit. If you followed buy signal, you should monitor the market to take profit or stop loss on time. You can use DataFeed notification to help you with market monitoring: for example you just bought SXP500 m15, go to Notifications screen and set notification for SPX500 m15 Trend reversal. Beware that DataFeed Trend indicator reversal does not mean that market will go south, but for sure it's serious warning.

How to close trade is big skill to learn for everyone.

How to trade DataFeed signals

AI server sends trades signals for SPX500, US30, NAS100, GER30, VN30F1M and some US/VN stocks for m15, m30 and D1 time frames. There are generally 3 cases can happen:

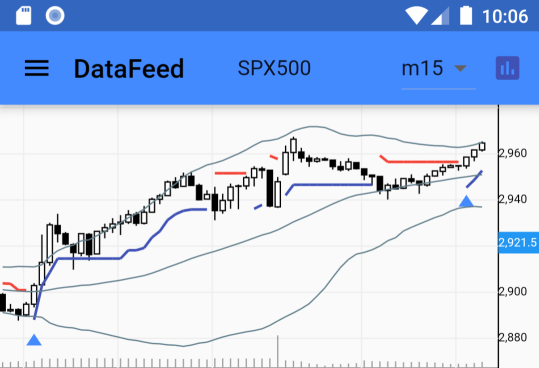

Market sky rocket immediately

Actually this case happens quite often

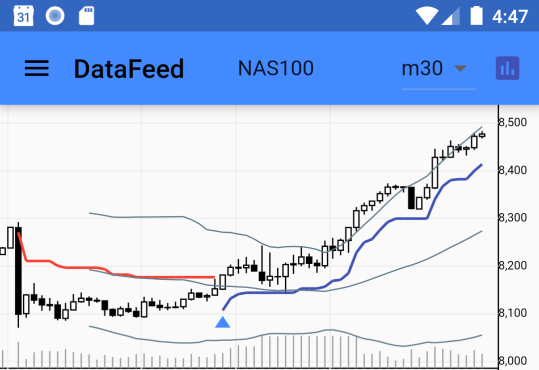

Market shakes tree little bit before take off

In this case we see that price touchs m30 trend line then go up.

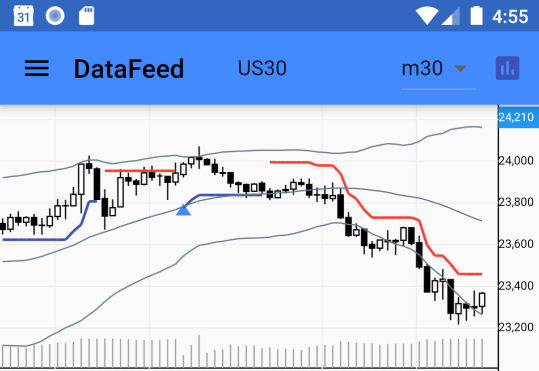

Market reverses uptrend shortly and goes south

In this case we see that buy signal was false positive. So close the (loss) trade with market order or wait little bit? Please get a look at H2 chart, if it still looks good, very good chance that we can get out without loss by using sell limit order at bought price, but you always should have stop loss strategy in the case things get worse.

As you see it's not easy to trade. This market is full of sharks and they don't give up money easily. Probably the best option is to buy half of planned trade size immediately after trade signal, then set buy limit order for remaining half at trend line. Please note that up trend line will go up, so maybe we have to adjust buy limit order price a bit. If things get worse, close all open positions, most important thing is to survive and trade another day. Don't use too much margin. Do not set target to become rich overnight. Play safe and you will go very far. Imagine that you have initial capital of US$1000 and your profit is 20% every month (which is very possible with DataFeed signals), after 3 years you will be almost millionaire.

DataFeed signals are typically more accurate after sale-off. You should also consider market sentiment before taking action.

How accurate are trade signals?

You can checkout past trade signals in app Trades screen. It's absolutely ridiculous, but almost every single trade signal is accurate. It looks like perfect scam! However you can easily verify power of our AI server brain and it's trade signals quality yourself during trial period.

How to improve trading performance?

It's not that important how often you're wrong. But how much you loss when you're wrong and how much you win when you're right really matters. So the key point is to cut loss when you relized that you're wrong, and let profit run when you're right. Trading is like war, you should have plan A,B and even C.

Do not trade too small time frame. Anything below m15 is not sustainable. Even m15 signals are not very reliable. Lower margin and higher time frame is the way to go.